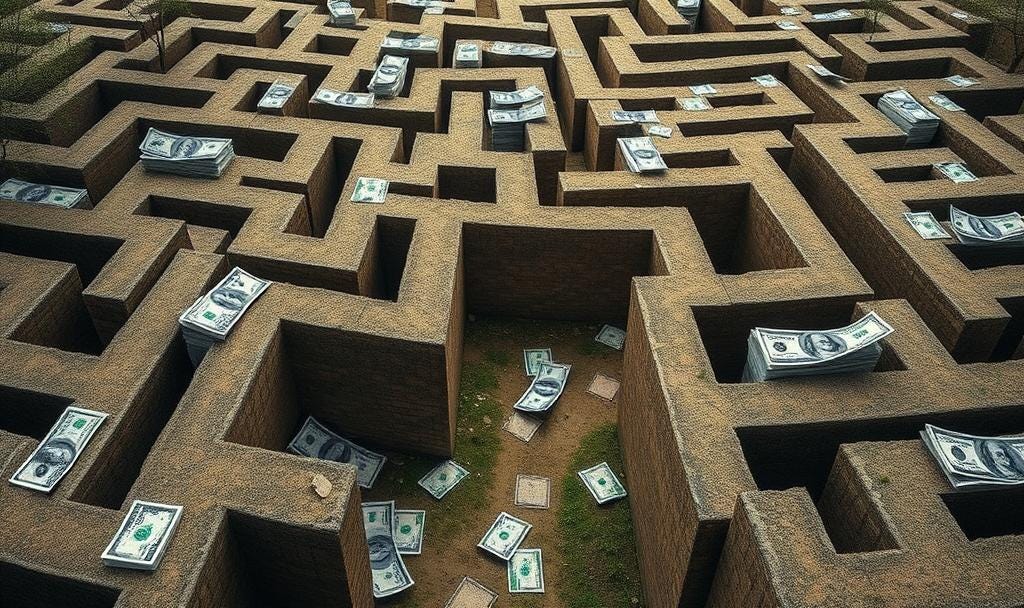

Navigating the Insurance Maze

What a Medical Biller and Cancer Survivor Taught Me About Healthcare Financial Survival

Jessica Gravel thought she had it all figured out. A healthy marathoner who had transformed her life by losing 90 pounds, she chose the cheapest health insurance plan because, frankly, she never planned to use it. Runners, she explains, tend to push through aches and pains rather than seek medical care.

Learn more about why “Taking it Easy” could kill you with Dr.Jay Harness

Then cancer threw her the ultimate curveball.

What Jessica discovered wasn't just that her cells had gone rogue—it was that navigating the healthcare bureaucracy would become the hardest race of her life. Her story illuminates the bewildering maze that cancer patients face, where insurance policies can shift the financial burden dramatically and where a simple shot can cost hundreds of dollars without warning.

The Insurance Roulette: When "Cheap" Becomes Expensive

Jessica's initial insurance choice—a low monthly premium with a high out-of-pocket maximum—meant she paid 100% of every medical expense until hitting her $6,000-$8,000 annual limit. This included paying the full cost of her biopsy, imaging, and diagnostic work. By the time her cancer was confirmed, she'd already maxed out her annual expenses, meaning her actual cancer treatment was fully covered.

"While I thought that first year was really, really hard and it was absurd that I am shelling out all this money," Jessica reflects, "once it actually was cancer, I ended up having the best insurance policy essentially for my situation."

This paradox reveals a critical insight: the insurance plan that seems most expensive upfront might actually be the most protective during a health crisis.

Read and Search the Transcript (Paid Subscribers Only)

The Bill That Blindsided Her

Fast-forward to Jessica's current insurance—a plan with lower deductibles and copays that seemed more reasonable. During a routine oncology visit, she expected to pay $18 based on her insurance portal. Instead, the receptionist asked for $416.

"Nobody will tell you anything at that register counter," Jessica explains. "You have to wait for the boss, so you have to go to another office. And then I go there, and of course she's in a meeting."

After days of phone tag and passive-aggressive messages, she learned the $400 was her 20% copay for a Lupron shot—a hormone therapy injection she receives every three months. The opacity of medical billing means patients often can't price-check or budget accurately for their care.

Hidden Costs Cancer Patients Face

Jessica's experience highlights several insurance landmines that catch cancer patients off guard:

Drug Cost Variations: The same medication can have wildly different copays depending on your specific plan structure. Jessica's Lupron shot costs $400 every three months under her current plan—information she only learned after the fact.

Geographic Restrictions: When Jessica traveled from Texas to Indiana, she couldn't fill her prescriptions because her doctor wasn't licensed in Indiana, and pharmacists couldn't transfer medications across state lines for controlled substances.

Physical Therapy Limits: Despite having seven surgeries since August 2023, Jessica's insurance caps her at 20 physical therapy sessions annually. When she needed hip repair, she faced an impossible choice: forgo PT before surgery to save sessions for afterward, pay out-of-pocket for additional sessions, or live with chronic pain.

Case Manager Confusion: When Jessica requested a case manager for help navigating her complex medical needs, the representative initially told her that "most people have more serious conditions." Only after Jessica clarified she was a cancer survivor did she qualify for assistance.

The Clinical Trial and Experimental Treatment Challenge

Jessica's story also illustrates how insurance coverage for cutting-edge treatments remains inconsistent. She qualified for Kisqali (ribociclib) only after the NATALEE study expanded its use to Stage II and III patients. Had her diagnosis come earlier, this potentially life-saving treatment might not have been covered.

Many patients don't realize that clinical trials—often providing access to the most advanced treatments—may actually reduce costs rather than increase them. However, insurance coverage for experimental treatments varies dramatically, and patients need advocates to help navigate these options.

What You Can Do to Protect Yourself

Based on Jessica's hard-won wisdom and financial best practices for cancer patients, here's your action plan: