Inside the Insurance Machine: What Cancer Patients Actually Need to Know

Tips from UnitedHealthcare California CEO, Steve Cain

What does your insurance company know about you that you don’t know they know?

The answer might change how you navigate your cancer treatment.

I sat down with Steve Cain, CEO of UnitedHealthcare California, and walked away with a completely different picture of what payers are doing behind the scenes. Not because the picture is perfect—Steve was the first to admit it isn’t—but because understanding how the system actually works gives you power within it.

The Data Triggers Action

When you get a mammogram, your insurance company sees the claim. When there’s a follow-up diagnostic, they see that too. When pharmacy data starts showing oncology drugs, patterns emerge.

Steve described their approach:

We look at the analytics and do some predictive modeling based on real-time claims data. There was a screening test for cancer, there was a diagnostic test—wait a second, there’s pharmacy data coming in. We have the ability to take that, it kind of risk stratifies it and says, this may deem an outreach.

So why don’t more patients get proactive calls?

The honest answer is messy. “It’s not perfect,” Steve admitted. “Who the heck picks up their phone anymore?” When your insurance company calls, most people assume it’s a billing issue or a sales pitch, not a lifeline.

This is a trust problem, and Steve acknowledged it directly: “Payers still have a ways to go to really build that trust bridge.”

But if you call them first, you bypass the algorithms and the phone screening hesitation. You get access to the system designed to help you.

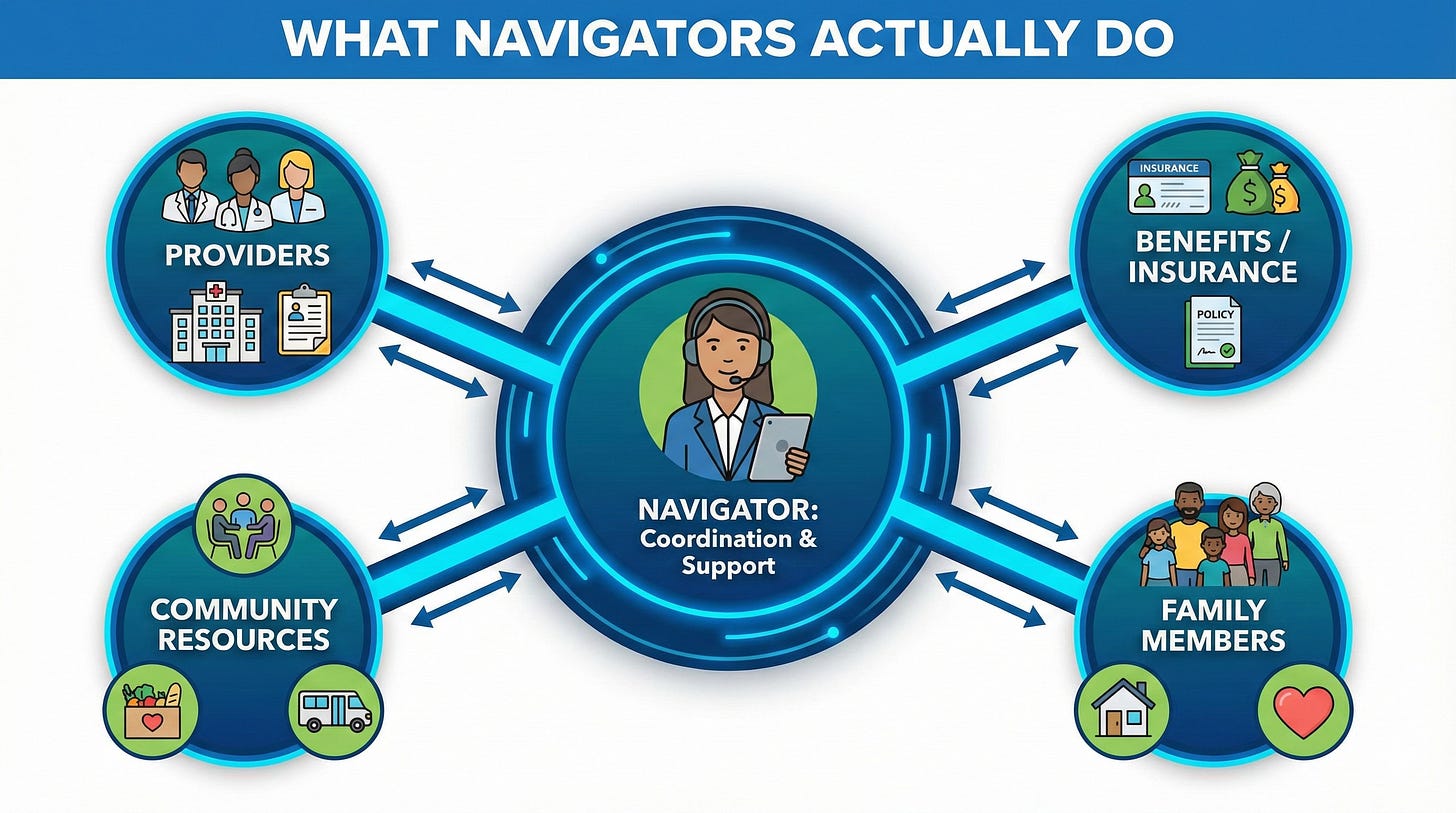

The Navigator System Most People Miss

UnitedHealthcare’s Cancer Support Program assigns one oncology nurse navigator to guide you through your entire treatment journey. These aren’t generalists: “We have over 100 registered nurses that have oncology experience.”

What do they actually do? More than you’d expect.

When Steve’s own father was diagnosed with cancer, his sister worked directly with someone equivalent to a cancer support navigator. “Making sure you bring people in, cancer’s a journey. You gotta have a support system,” he said. “

When you’re trying to figure it on your own, things slip through the cracks. You didn’t hear it right. Who the heck can sit there and comprehend that level of information when you figure out you have cancer?

The navigator coordinates between your providers, connects you to community resources, helps you understand your specific benefits, and can even work with your family members. Steve was clear: “A family member can call on your behalf and say, ‘I need some information,’ and we can help that family member help the patient.”

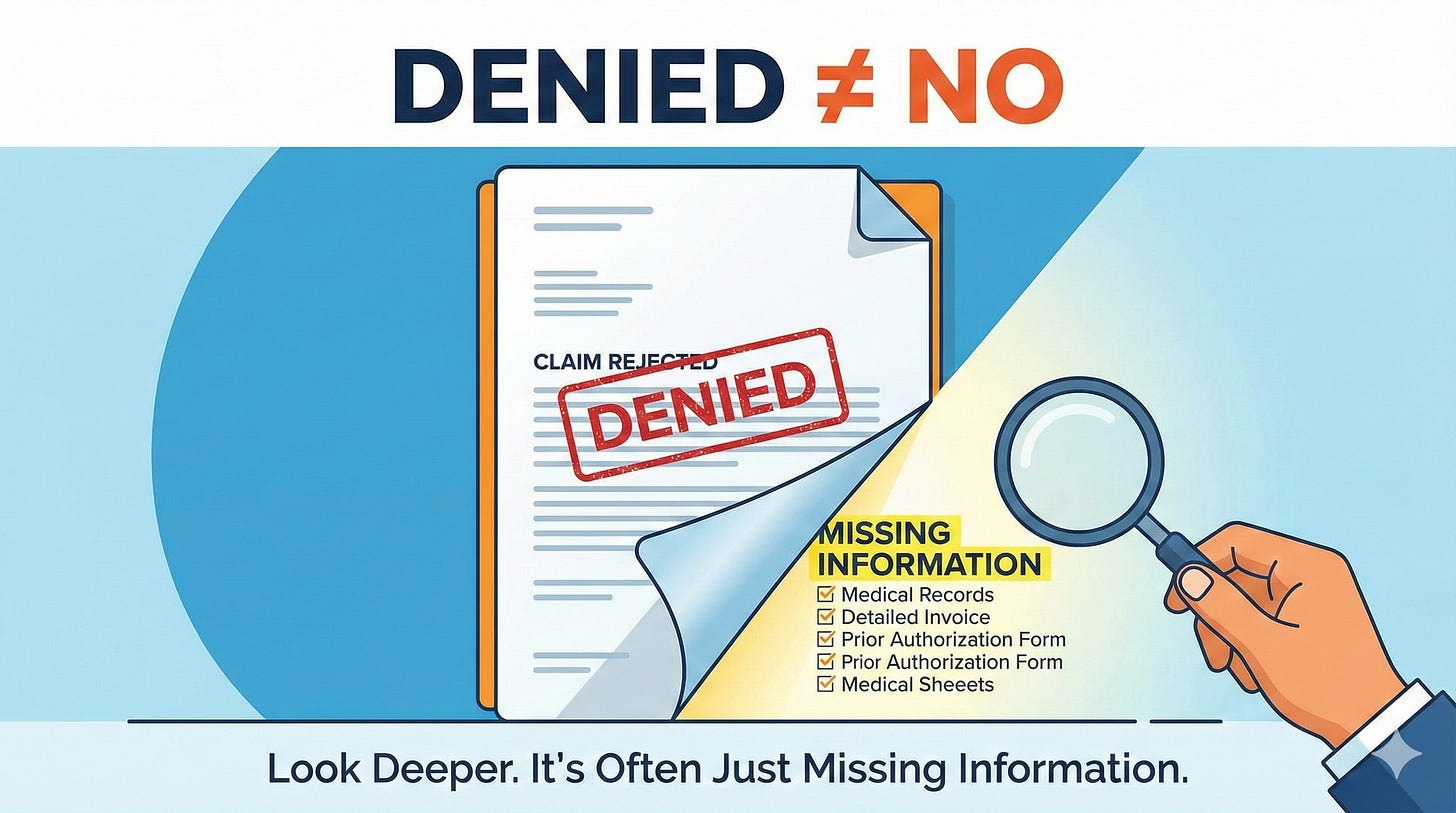

The Denial Letter Isn’t the Final Word

When I brought up the fear patients have—”my doctor says I need this treatment, but insurance denied it”—Steve didn’t dodge.

He explained that most first denials aren’t actually rejections of care. “A lot of denials—the first denial is really because the insurance company didn’t get the right level of information.”

This matters because patients often see “denied” and think the answer is no. In reality, the answer is often “we need more information from your provider.”

UnitedHealthcare built something called the Cancer Guidance Program specifically to address this. It integrates NCCN (National Comprehensive Cancer Network) guidelines directly into provider EMRs, so physicians can follow established pathways and obtain prior authorization approvals in hours rather than weeks.

If the doctor uses that platform and they follow the pathways, we’re talking about hours, not days and weeks, where these prior authorizations get approved, Steve said.

Your action item: If you get a denial, don’t panic. Call your provider first and ask them to review what was submitted. Then call your insurance company—or your navigator, if you have one—and ask what specific information is missing.

Why Removing the Cost Barrier for Screenings Matters

UnitedHealthcare California eliminated copays for cancer screenings and first diagnostic tests. The rationale was straightforward: “When you make it zero copays, people actually go get the test.”

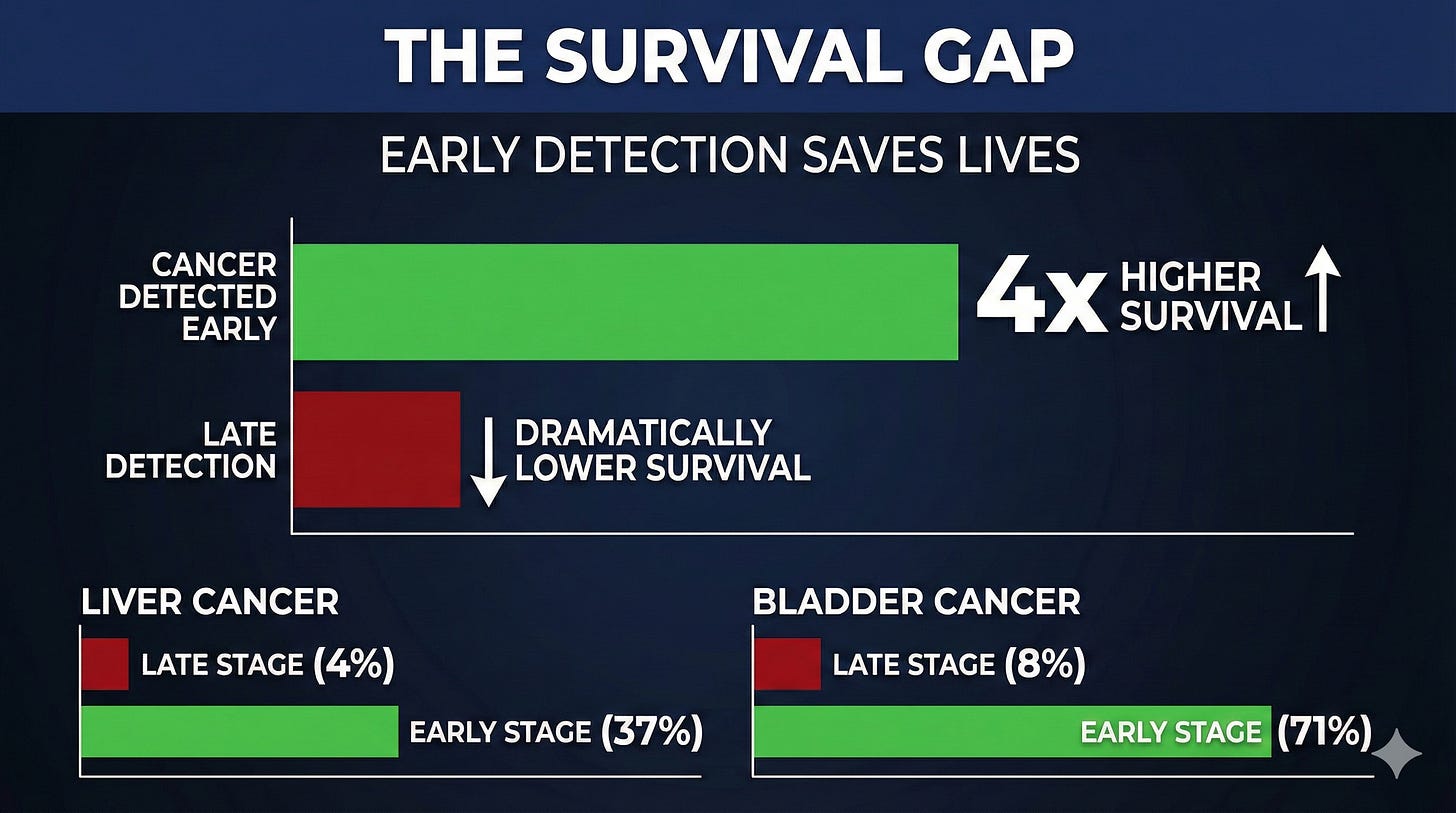

The data backs this up—and it’s not subtle. According to research from NORC at the University of Chicago, survival rates are four times higher when cancer is detected early compared to late-stage detection. Yet roughly 50% of cancers are still diagnosed at an advanced stage.

Steve walked through the real-world scenario: “Let’s say they’re working. Mom, two kids, they’re making ends meet, barely making minimum wage. They might just decide, ‘I can’t do that right now.’ And if they decide to do that and delay care, you know the outcomes only get worse.”

The survival difference isn’t marginal. For liver cancer, survival rates improve from 4% to 37% when caught early. For bladder cancer, the five-year survival rate jumps from 8% to 71%.

By removing the financial barrier for screenings and that first follow-up diagnostic, payers are trying to catch cancer earlier—when it’s most treatable.

This won’t apply to everyone. Benefit plans vary by employer. But it’s worth asking your insurance company directly: Are my cancer screenings and first diagnostic tests zero copay?

Clinical Trials: What to Know

When I asked Steve about clinical trial coverage, his answer was measured but supportive: “United does not arbitrarily just deny all clinical trials. We support clinical trials on a regular basis.”

The key, he emphasized, was safety and understanding the data: “We are always gonna make sure that we’re doing what’s right for the member from a safety perspective and that we understand the data and the science.”

If you’re considering a clinical trial, your navigator can help you understand what’s covered and work with your provider to ensure the necessary information is submitted.

What This Means for You

Steve’s core advice was disarmingly simple: “Call us. Get into the program. Allow us to help support your journey.”

And when I asked what cancer patients and families should do differently, his answer landed: “Be relentless.”

Relentless in reaching out. Relentless in getting answers. Relentless in making sure no resource goes untapped.

The system is imperfect. But the people inside it—the navigators, the oncology nurses, even the CEO of a major insurance company—are working on making it better. Your job is to reach out and let them help.

Listen to the full episode for Steve’s perspective on how AI will transform care coordination, what prior authorization actually protects against, and the housing investments UnitedHealthcare is making to address social determinants of health.

Accessing UHC California Cancer Support

Cancer Support Program | UHCprovider.com

People can also call 866-936-6002

Links

NORC at the University of Chicago

Statistic: “When cancer is detected in earlier stages, survival rates are four times higher compared to late-stage detection”

Science / PubMed (Crosby et al., 2022)

Statistic: “~50% of cancers are at an advanced stage when diagnosed”

Scientific Reports / PMC (Lau et al., 2025)

Statistics:

Liver cancer: five-year survival rate improves from 4% to 37% when caught early

Bladder cancer: five-year survival rate improves from 8% to 71% when caught early